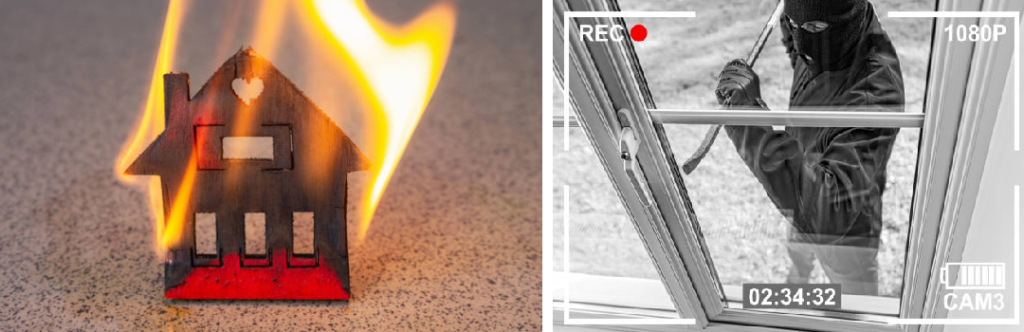

In the recent past, the country has witnessed a rise in arson attacks. This has affected personal properties, businesses and schools. Reports indicate that in the last few years, unprecedented losses have arisen out of arson targeting business interests. In the year 2016, there was a national debate surrounding the torching of schools countrywide (most of which accounted for the 773 cases according to the Annual Crimes Report, 2016). 1452 cases were reported the same year under burglary. It is important to note that most fire policies do not offer coverage for arson. Most policies have a standard exclusion of fires caused by arson. This exclusion however does not divest insurers from compensating policyholders whose properties are damaged under the basic fire policy.

The nonchalant attitude expressed by most business owners and persons of interest when approached to consider purchasing a Fire and Burglary policy is wanting. The burning question is why don’t most businessmen (and women) purchase a Fire and Burglary policy in the wake of existing threats such as fire, lightning and limited explosions? The truth of the matter is that most of them care enough for their businesses and would do anything to mitigate or forestall any losses. Buying an insurance plan however is the least among such considerations. The rising spate of burglaries according to the same report accounts for 1.85% of the total crimes reported that year. The unreported cases are a staggering number.

In light of the above, insurers have a sacred duty to educate people (business owners, home and property owners e.t.c) about the importance of having such a policy in place. The National Crime Research Centre does not mention the role of insurance in mitigating such losses in its recommendations in an assessment of arsons targeting schools (Rapid Assessment of Arsons in Secondary Schools in Kenya – July – August 2016).

This therefore calls for an understanding of what a Fire and Burglary policy can do for you. Below are the benefits under a fire policy:

- Provides compensation or covers damage to property caused by fire, lightning and limited explosion.

- Additional perils under a fire policy can include: Storm(s), tempest and flood, Impact damage, Explosion, Earthquake, Riot and civil commotion, Impact damage, Aircraft, Malicious damage.

A fire policy will cover buildings, plant and machinery, rent payable and receivable and stock (e.g. for traders).

Burglary provides financial compensation for loss or damage to property and valuable items due to burglary. Burglary by definition is the actual forcible and violent breaking into or out of the premises and visible means or any attempt(s) thereat. It is a crime that involves theft and constitutes unlawful entry.

This kind on entry can cause physical loss or damage or destruction to buildings and loss or damage to stock or machinery.

Now let us address why it is important to have this kind of policy in place:

- A single occurrence can wipe out your fortune. It is important to cushion yourself against future unforeseen losses.

- Damage to premises as a result of burglary will be covered. This will extend to property stolen in the course of burglary.

- Having an insurance policy in place offers peace of mind. This will enable you concentrate on your core business with ease.

- Your buildings and contents have sufficient protection.

- Ensures business continuity in the event of a loss.

When taking these policies, it is important to go through the exclusions as well. Exclusions narrow the scope of coverage and expressly state what is not covered in the policy.

Article by: William A. Obonyo